Often people have no idea what documents they should keep or how long they should keep them for. So, they end up collecting piles of paperwork, until their drawers are at bursting point.

If this sounds like you, it’s probably time to have a clear-out. Just follow our simple guidelines below to find out how long you should keep certain documents and the best way to organise them.

The good thing is, once you’ve sorted out your paperwork, it’ll be much easier to keep on top of it in the future - and you’ll never feel bogged down by admin ever again.

How many years of bank statements should you keep?

If you don’t have online banking and receive your bank statements in the post, you should keep them for at least two years.

Is it safe to throw away old bank statements?

Bank statements hold a lot of sensitive information. So, instead of throwing them straight in the rubbish bin, you should shred them first. This should help to prevent fraudsters from getting hold of your card number and other details that they could use to access funds in your account.

How long do you have to keep records for HMRC?

If you’re self-employed, you must keep hold of your records for at least 5 years after the 31st January tax return deadline for the relevant tax year. This is in case HMRC needs to check your records at any point to make sure you’re paying the right amount of tax.

If you’re a sole trader with a small business, you’ll also need to keep your records for at least 5 years after the date you submitted a tax return. Make sure you keep records of both your business and personal income over the course of 5 years.

If you’re a director of a limited company, you’ll need to keep business records for at least 6 years, starting from the end of the financial year.

Should I keep old P60s and wage slips?

P60s and P45s should be kept for at least 2 years from the end of the relevant tax year. Once you receive your annual P60, you can shred your wage slips for that year.

What about insurance documents?

You only need to keep hold of insurance documents until your policy expires or is renewed. Once your new policy is set up, you can get rid of your old documents. But if you have a proof of no claims letter, you may want to keep hold of it as evidence.

How many years of utility bills should I keep?

With utility bills, there’s no need to keep the documents for more than a year. Keeping them on record for a year is helpful for comparison purposes when it comes to finding a new deal.

What documents do I need to keep forever?

There are some documents that you should keep for your lifetime, as they are difficult to replace. These include:

- birth certificates

- marriage certificates

- death certificates

- adoption records

- house deeds

- National Insurance card

- pension documents

- medical records

- vet records

- wills

- life insurance documents

Tip: Make sure your beneficiaries know where your will and life insurance documents are kept.

It’s important to keep these documents safe, as they can be costly to replace. For example, if you’ve lost a birth, marriage or death certificate, or adoption record, you’ll need to request a new copy by post. This costs £11 each (or you can pay £35 to receive it the next working day).

Documents you need to keep for their lifetime

There are some documents that you should keep hold of until they expire, such as your:

- passport

- extended warranties

- V5C logbook - until you sell your car

- other vehicle documents - e.g., car insurance, road tax and MOT paperwork

- rental contracts - until you’ve left the property and received your deposit back

- photocard driving licence - the paper counterpart has had no legal status since 8th June 2015)

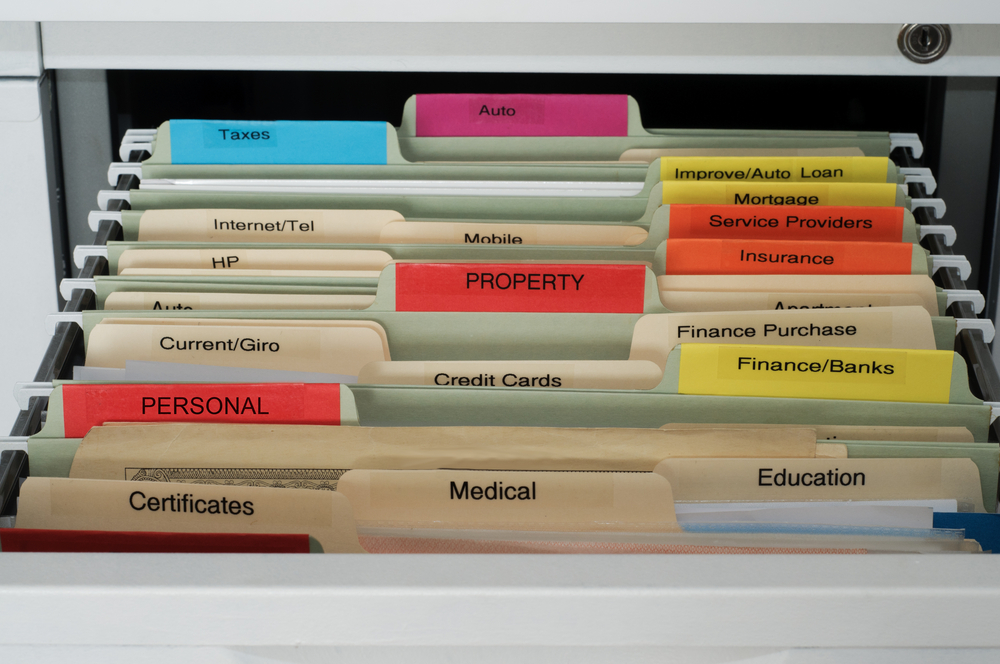

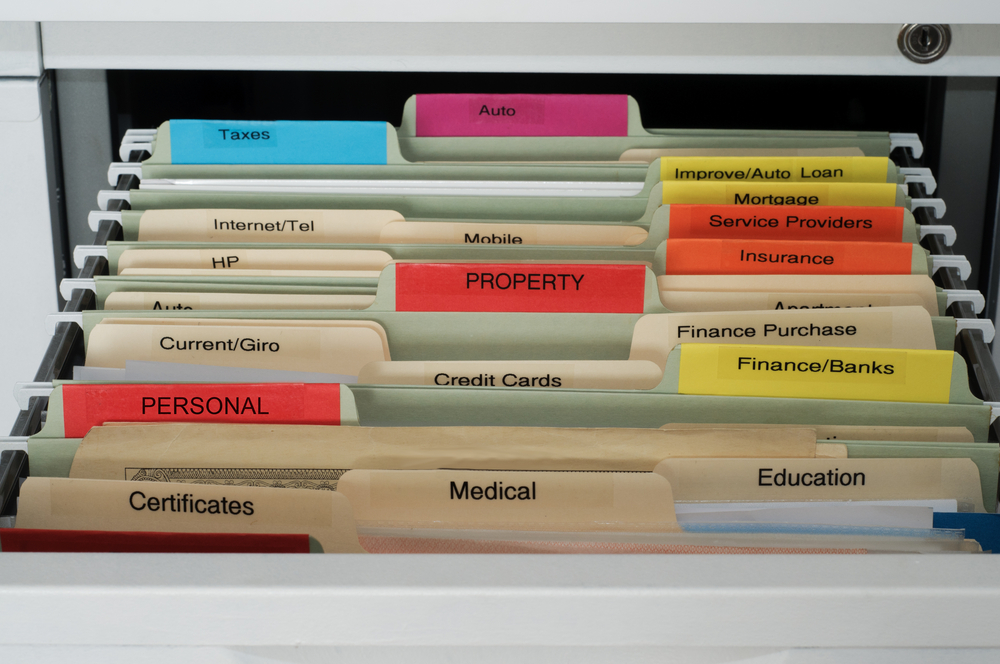

How to organise life admin

Now that you know what to keep and how long to keep it for, it’s time to do some personal admin. You should do this in whatever way makes the most sense to you.

Perhaps you could have one folder for documents you are going to keep forever, one for documents you are going to keep for 5 years, one for 2 years and so on. Or you could organise your paperwork into categories like ‘utility bills’, ‘mortgage’, ‘car documents’, for example.

With each folder, you could keep the oldest document in the front and the newest at the back. This way when it’s time to get rid of some paperwork, you’ll only need to check the front of the folders to see which documents need to go in the bin.

Invest in some stationery

Whichever way you decide to organise your paperwork, you’ll need to invest in some stationery. The basics should include ring binders, transparent plastic wallets, pens and sticky labels.

Keep on top of your post

Set aside a separate folder or box for your new post to go in, and sort through it every few days. That way, you can keep track of your bills and make sure you don’t miss any payments. Then, once the post has been dealt with, you can file it away.

Pay for bills online

If you opt to pay your bills online, you’ll always have a digital record of your payments and won’t need to worry about adding more paperwork to your filing system.

Fancy more decluttering? Find out how to turn your clutter into cash.

Adele is a personal finance writer with more than 10 years in the finance industry behind her. She writes clear and engaging guides on all things loans for Ocean, as well as contributing blogs to help people understand their options when it comes to money.

![Email icon]()

Become a money maestro!

Sign up for tips on how to improve your credit score, offers and deals to help you save money, exclusive competitions and exciting products!

Find this useful? Share it with others!