What is a bad credit loan?

Life happens, and anyone can fall into financial difficulties. If you've faced credit challenges in the past, bad credit loans offer a way forward.

Bad credit loans work just like regular loans - you get the money upfront and pay it back monthly with interest.

They are designed for people with bad credit, so you might get approved even when other lenders have turned you down.

Whether it's for home improvements, consolidating debt, or covering other expenses, we've got your back.

Just make sure the monthly payments fit comfortably in your budget before you commit.

Comparing won't harm your credit score

Homeowner loans are secured against your property. This means your home may be at risk if you fall behind with your payments. We are a broker and we arrange secured loans from a panel of lenders. We receive commission upon completion. Fees may be payable depending on your choice of financial product. The rate you're offered and the fees will depend on your circumstances and will be discussed prior to you proceeding with your loan. 11.0% APRC Representative.

Personal loans are unsecured. Ocean Finance is a trading style of Intelligent Lending Limited. We are a credit broker working with a panel of lenders to find you a personal loan. We receive commission upon completion. A Broker Fee is not payable. 59.9% APR Representative (fixed).

How to check your eligibility for a bad credit loan

See if you're eligible in four simple steps - without impacting your credit score.

- Click 'Compare bad credit loans' and select how much you want to borrow and for how long

- Fill in our quick and easy form

- We’ll search 100s of loans to see what's right for you

- View your quotes – these will either be personal or secured loan quotes, depending on how much you want to borrow and if you’re a homeowner

To check your eligibility, we just need your contact, income and employment details.

What types of loan can I get with bad credit?

There are several loan types for bad credit, which include:

Personal loans

Personal loans are unsecured, meaning they aren’t tied to any assets such as your home. The rate you’ll receive depends on your credit history and personal circumstances.

We offer personal loans from £1,000 to £15,000 over 1 to 5 years.

Secured loans

You must own your home to apply, as it is used as security for the loan. This means you are more likely to get a better deal, even if you have a bad credit history.

We work with a panel of lenders to find the best rates for secured loans from £10,000 to £500,000 over 3 to 30 years.

Debt consolidation loans

Debt consolidation loans combine your existing repayments into one, often at a lower rate. It simplifies payments but may result in paying more over time.

With us, it’s possible to get personal or secured debt consolidation loans for bad credit.

Personal loans

Personal loans are unsecured, meaning they aren’t tied to any assets such as your home. The rate you’ll receive depends on your credit history and personal circumstances.

We offer personal loans from £1,000 to £15,000 over 1 to 5 years.

Secured loans

You must own your home to apply, as it is used as security for the loan. This means you are more likely to qualify and receive favourable terms, even if you have a bad credit history.

We work with a panel of lenders to find the best rates for secured loans from £10,000 to £500,000 over 3 to 30 years.

Debt consolidation loans

Debt consolidation loans combine your existing repayments into one, often at a lower rate. It simplifies payments but may result in paying more over time.

With us, it’s possible to get personal or secured debt consolidation loans for bad credit.

Ocean Finance is a trading style of Intelligent Lending Limited. We are a credit broker working with a panel of lenders to find you a loan. Your property could be at risk if you fail to keep up with repayments.

Bad credit…?

We’ve got your back

Mr & Mrs Andrews…

Had previously missed loan payments, been in arrears on their mortgage, and had a CCJ.

They were able to get a secured loan for £21,400 with Ocean and reduced their monthly outgoings from £976 to £265.

Credit history:

CCJ and mortgage arrears

Loan amount:

£21,400

Monthly reduction:

£711

Won't harm your credit score

Remember, if you consolidate your existing borrowing, you may be extending the term and increasing the amount you repay in total.

Customer name has been changed to protect their privacy. Average reduction in outgoings of more than £700 per month for customers taking a loan for debt consolidation in the last 12 months.

Who can apply?

Each lender will have their own criteria, but common requirements include that you must be:

- Aged 18 years or older

- A resident of the UK

If you’re a homeowner, you may be eligible for a secured loan, which typically comes with lower interest rates.

4 reasons to choose Ocean

Flexible loan options

Solutions tailored to your needs

Over 30 years' experience

Exceptional Feefo rating

How long does it take to get a loan?

This depends on the type of loan you apply for.

Personal loan

Applying online for a personal loan is quick and easy. Sometimes, you can even have the money in your bank account the same day.

Secured loan

Secured loans are typically funded within 2 or 3 days after your loan offer has been issued by the lender. We’ll work with you, the lender and any third parties to ensure your offer is sent out as soon as possible.

Does a bad credit loan affect my credit score?

A bad credit loan can have a positive or negative impact on your credit score – it all depends on how you manage repayments.

If you keep up with your repayments each month, this can have a positive effect on your credit score and improve it over time.

However, if you miss payments or are late, this will have a negative impact and lower your score.

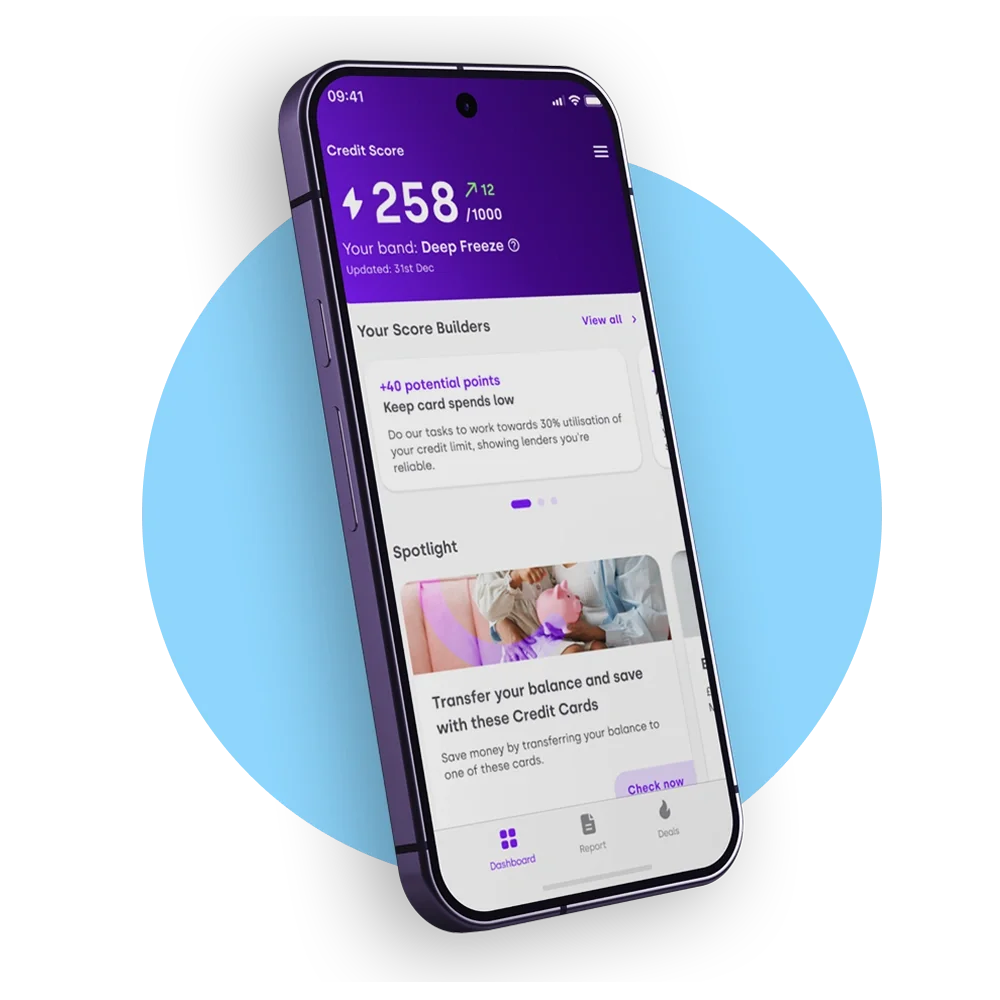

What is a bad credit score?

Each of the three main credit reference agencies use their own scoring system, so there’s no fixed definition of a 'good' or ‘bad’ credit score.

Here's how the different credit reference agencies consider their scores:

| Credit score | Equifax | Experian | TransUnion |

| Very poor | – | 0 – 560 | 0 – 550 |

| Poor | 0 – 438 | 561 - 720 | 551 - 565 |

| Fair | 439 - 530 | 721 - 880 | 566 - 603 |

| Good | 531 - 670 | 881 - 960 | 604 - 627 |

| Very good | 671 - 810 | - | - |

| Excellent | 811 - 1000 | 961 - 999 | 628 - 710 |

Remember, we can offer loans for people from each of these categories, so don’t let a previous decline put you off checking your eligibility.

How to improve your credit rating for a loan

Bad credit isn’t forever, and there are plenty of things you can do to rebuild your score. This can then improve your chances of being accepted for better deals in the future.

Here are a few tips and how they could improve your score…

- Keep up with existing payments (increase your score by up to 95 points) – While late or missed payments can have a negative effect, making them in full and on time can boost your credit score and build up your credit history.

- Limit applications (increase your score by up to 125 points) – Multiple hard searches on your credit report can lower your score temporarily. Using an eligibility checker to see your loan options helps protect your score, as it doesn’t leave a mark on your credit report.

- Register to vote (increase your score by up to 60 points) – If you haven’t already, get on the electoral roll. It only takes five minutes online, and helps verify your identity to lenders.

Got Questions?

Bad credit refers to a low credit score, often resulting from late payments, defaults, or high levels of debt. It indicates to lenders that a borrower may be a higher risk, making it harder to get loans, credit cards, or favourable interest rates.

Although your options may be limited, there are certain lenders who offer products specifically for people in this situation. Here at Ocean, we can compare loans for you to find the best deal you’re eligible for from our panel of lenders.

A bad credit score can result from several factors, including:

missed or late payments on credit accounts

carrying high levels of debt

having a short credit history

or frequently applying for new credit

Negative marks such as defaults, bankruptcies, or county court judgments (CCJs) can also lower your score.

This comes down to the perceived risk for the lender. If you’ve had issues with credit in the past, the worry is that you might again. This can mean being offered lower loan amounts and charged higher interest rates to balance out that risk.

It’s a big commitment to get any kind of loan, so it’s important that you make the right decision to suit your circumstances. Here are some things you should consider before you apply:

Your affordability - Review your budget and how much you can afford to borrow each month.

Loan type - You should explore your options and weigh up the pros and cons of unsecured loans and secured loans. Secured loans can allow you to borrow larger amounts against your home, with lower interest rates than personal loans. But your home could be at risk if you fall behind with your repayments.

Interest rates - Borrowing when you have a poor credit score can be costly as the lender may apply higher interest rates. You could shop around to find the best deal you’re eligible for - or work on improving your credit score first to boost your chances of getting accepted with better rates.

Your eligibility - Before you apply, use eligibility checkers to find out the likelihood of being accepted – without affecting your credit score. Remember, you must be a homeowner to be eligible for a secured loan.

To apply for a bad credit loan, you typically need:

Proof of income, e.g. payslips or bank statements

Identification, e.g. a passport or driver’s licence

Proof of address, e.g. a utility bill

Lenders will also check your credit score and may require details of any existing debts.

Yes, you can pay off your loan early. Some lenders may allow you to make overpayments to clear your loan quicker or give you the option to pay it off in full at any time. You may be charged an early repayment charge (ERC) if doing so, however we have options that mean you may be able to do this without incurring an additional cost.

There are various loan types for bad credit, and whilst some include guarantor options, there are also many that don’t. Here at Ocean, we offer bad credit loans without the need for a guarantor.

It’s possible to see your quotes without affecting your credit score, but a hard credit check will always take place during the actual application. This is the same for all credit products.

Homeowner loans are secured against your property. This means your home may be at risk if you fall behind with your secured loan or mortgage repayments.

Remember, if you consolidate your existing borrowing, you may be extending the term and increasing the amount you repay in total.

Last updated

Fact-checked

This page has been reviewed to ensure it is accurate and compliant with FCA guidelines.

For more information on our fact-checking process, read our editorial policy.