What is a credit check?

A credit check is when a lender looks at your credit report to help them decide whether to lend to you. It shows how you’ve handled borrowing in the past, including:

-

Your current borrowing (like loans or other credit cards)

-

Your credit utilisation (how much of your available credit you use)

Most credit card companies carry out a hard credit check when you apply. This leaves a mark on your credit report, and lenders can see it. Too many hard checks in a short space of time can affect your score.

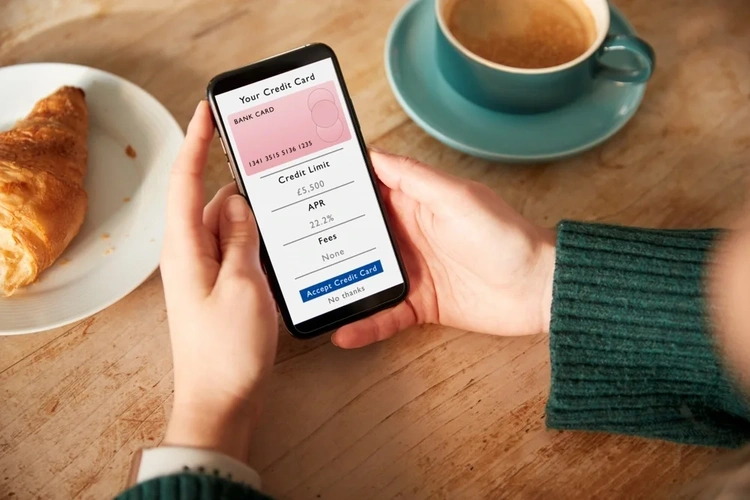

Can you get a credit card without a credit check?

In most cases, no — if a company is offering to lend you money, they’ll want to do a credit check first. This helps them work out the risk and decide on your credit limit and interest rate.

However, there are a few exceptions:

Prepaid cards

Prepaid cards aren’t credit cards, but they can be an option if you’re trying to avoid a credit check. You load money onto them and spend only what you’ve added. There’s no borrowing involved, so most providers don’t do a credit check.

Some prepaid cards also help you build your credit score by reporting your usage to credit reference agencies — but not all do, so it’s worth checking before you apply.

Credit builder cards with eligibility checkers

You can’t skip the credit check altogether, but many lenders now offer eligibility checkers. These are soft checks that don’t affect your credit score.

You’ll answer a few questions about your income, credit history, and other details, and the tool will tell you how likely you are to be accepted. If the results look good, you can then choose to go ahead with a full application (which includes a hard credit check).

Are no-credit-check credit cards safe?

Be very careful if you see a company offering a “no credit check credit card” — especially if it’s not a well-known lender. Some may charge high upfront fees, come with unfair terms, or even be scams.

Here are some warning signs to look out for:

-

Asking for money before you’ve been approved

-

Guaranteeing approval, no matter your situation

-

Not being regulated by the Financial Conduct Authority (FCA)

-

Poor online reviews or hard-to-find contact details

Always check if the company is authorised by the FCA before you apply. You can do this for free on the FCA Register.

What are your options if you have bad credit?

If your credit score is low, you still have options. Many lenders offer credit cards designed for people with poor or limited credit history. These are called credit builder cards.

Ocean Credit Card

See if it's a YES before you apply

- Up to £8,000 credit limit

- Checking won't affect your credit score

- Get a response in 60 seconds

Intelligent Lending Ltd (credit broker). Capital One is the exclusive lender.

What is a credit builder card?

A credit builder card works like a normal credit card but usually comes with:

-

A low credit limit (often £200 to £1,200)

-

A high interest rate

-

The chance to build or improve your credit score over time

If you make your payments on time and stay within your limit, this shows lenders you can borrow responsibly, which could improve your score.

Tips to improve your chances of being accepted

Here are some steps you can take before applying for a credit card:

1. Check your credit score and report

You can do this for free with credit reference agencies like:

Look out for any errors and get them fixed if needed.

2. Register to vote

Being on the electoral roll helps lenders confirm your identity and address.

3. Use an eligibility checker

This can help you avoid applying for cards you’re unlikely to get, which protects your credit score.

4. Reduce your existing debts

If you already have a lot of borrowing, try to pay some of it down before applying.

What to do if you’re declined for a credit card

Being turned down can feel disheartening, but you’re not alone — and it doesn’t mean you’re out of options.

Here’s what you can do next:

-

Don’t apply again straight away – this can damage your score

-

Check your credit report to understand why you were declined

-

Try other ways of building credit, like joining the electoral roll or paying off small debts

-

Speak to a money advice service or check what free, personalised support is available to you.

Where to get help

If you’re unsure about your options or struggling with debt, there are free and confidential services that can help:

You’ve got more options than you might think

Most credit card companies will run a credit check before approving your application. But if your credit score is low, there are still safe and realistic options to help you move forward. From credit builder cards to prepaid cards, and soft-check tools that protect your score, you’ve got choices — and support if you need it.

Disclaimer: We make every effort to ensure content is correct when published. Information on this website doesn't constitute financial advice, and we aren't responsible for the content of any external sites.