3 out of 4 customers improved their credit score*

How can a current account improve your credit score?

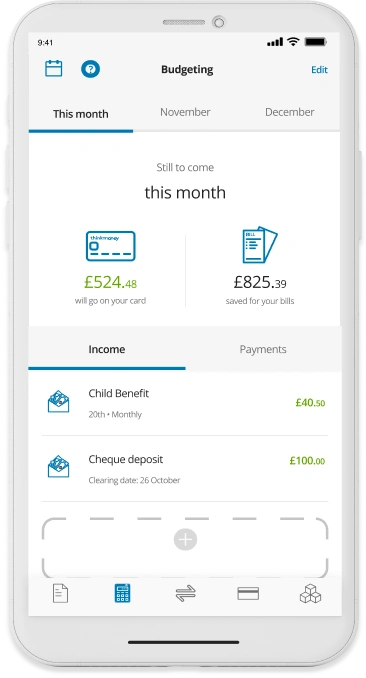

Make sure your bills are paid on time, every time

Stay in control of your overall finances

*Based on a sample of customers who held an account for 12 months and previously had limited credit history or substantial credit use

Easy, everyday digital banking

- You can register on your phone in minutes. Your identity is checked with a photo and screenshots through the app.

- Pay in money. It’s easy to alter where your salary is paid, just update the bank details with your employer.

- No monthly minimum. Can’t guarantee a certain amount each month? That’s fine, there’s no minimum monthly deposit amount.

The thinkmoney current account is provided by Think Money Limited who are authorised and regulated by the Financial Conduct Authority. FRN 685963. Co Reg No. 05530040.

Google Play is a trademark of Google Inc. Apple, and the Apple logo are trademarks of Apple Inc, registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Based on a sample of customers who held an account for 12 months and previously had limited credit history or substantial credit use.

All you need is to be aged 18 or over, live in the UK and pass our security checks.